Everything you need to know about zero-rating your purchases from Comptoir Nautique

If you're visiting France or the EU and wish to transport your equipment in your luggage to your country of residence outside the EU

, you can benefit from VAT refunds on purchases made from Comptoirnautique.com

What are the conditions for zero-rating?

In order to benefit from zero-rating, you must meet certain conditions, otherwise you won't be able to claim a VAT refund on your purchases.

1️⃣ You must reside outside the European Union

Whatever your nationality, you are eligible for zero-rating if (and only if) you reside in a non-EU country.

2️⃣ A minimum purchase threshold is set by each country in order to qualify for tax-free status

Tax-free status applies to goods valued at over €175, including VAT. Services, shipping costs and repairs are not eligible.

3️⃣ You must leave the EU before the end of the third month following the month of purchase

Goods must be zero-rated, i.e. you must leave the EU with the items and obtain customs validation of your zero-rating slip, no later than the last day of the third month following the month of purchase. Please note that your stay in the EU must be less than 6 months.

4️⃣ You must leave the EU with all the goods you wish to tax-free

To be able to buy tax-free, you must take the goods out of the EU with you, in your luggage. If the goods remain in the EU, they cannot be zero-rated.

⚠️ Note that these goods must also be new and unused before leaving the territory.

How do I go about zero-rating my purchases?

To buy tax-free on our website comptoirnautique.com, you have two options:

|

🖱️ Via our sales department

The PABLO tax exemption slip will be enclosed in your parcel. You will need to scan this form at the airport terminal when boarding. The VAT amount will be reimbursed to you on receipt of the tax-free validation, after deduction of our handling fee of 20% of the total VAT amount. This fee covers administrative management and bank charges. |

|

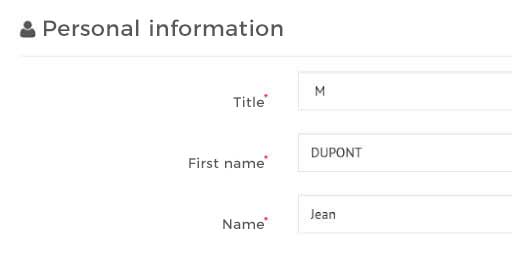

💻 Via our partner zapptax.comzapptax.com is approved by tax and customs authorities.

"ZAPPTAX 23, rue Jean-Jacques Rousseau 75001 Paris, France" ⚠️ it is no longer possible to modify an invoice once it has been issued. |

|

|

- Billing will be in VAT, due to delivery in France, Belgium or Spain (Zapptax service not available in other countries).

- Log on to the Zapptax application and upload your documents to obtain your tax-free invoice.

- Have your tax refund form validated by customs officials (stamp or scan).

- Download your stamped tax refund slip.

- Receive your refund within a few hours.

Need more information about our partner Zapptax? Check out their website and Frequently Asked Questions.